What to do when an IRS notice shows up in your mailbox

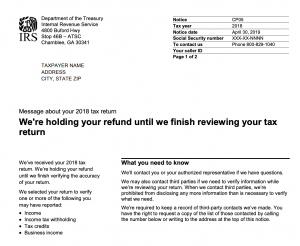

In the course of a typical person’s lifetime, they likely have very little interaction with the IRS. However, it is possible to receive a legitimate written piece of correspondence from the IRS. What next?

In the course of a typical person’s lifetime, they likely have very little interaction with the IRS. However, it is possible to receive a legitimate written piece of correspondence from the IRS. What next?

The most important response is to not panic, and certainly don’t throw the notice away and never address it. The IRS sends out millions of letters each year for a variety of reasons. Most of the time there is, in fact, no additional amount due or penalty looming. The IRS just needs you to clarify or add information you may have omitted on your return.

Sometimes, however, you may owe additional tax. Usually, this is because you received a form (like a dividend statement) that wasn’t included on your return. In that case, check to see if they are charging penalties (penalties are charged at the discretion of the IRS, and most of the time they don’t charge them). If there are penalties, don’t just pay them. First, contact your accountant at ShindelRock and see what your options are. Penalties can sometimes be removed (again, at the discretion of the IRS) and we can work out the best way to approach them to increase your chance of getting them removed.

Correspondence from the IRS doesn’t have to feel overwhelming or confusing. The tax professionals at ShindelRock are ready to help you navigate the interaction and resolve the matter as quickly, and affordably, as possible.