SR Client Question: What is considered a “service” for 1099 reporting purposes?

In light of the higher penalties for failure to file Form 1099s correctly, examining your business’ vendor payments is more important than ever before. While many transactions will be fairly straightforward and clearly not merit a 1099-NEC, some vendor lines are less clear. If you get your delivery vehicle repaired at a shop, that’s a service even though parts are involved. But what if you just buy new tires for example, and they install the tires–does that qualify as a service, and how would you distinguish between the two parts of the transaction? What about the sign company changing your sign–is that a service or the purchase of a new asset?

In light of the higher penalties for failure to file Form 1099s correctly, examining your business’ vendor payments is more important than ever before. While many transactions will be fairly straightforward and clearly not merit a 1099-NEC, some vendor lines are less clear. If you get your delivery vehicle repaired at a shop, that’s a service even though parts are involved. But what if you just buy new tires for example, and they install the tires–does that qualify as a service, and how would you distinguish between the two parts of the transaction? What about the sign company changing your sign–is that a service or the purchase of a new asset?

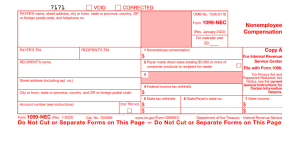

To help taxpayers distinguish, the IRS has released a list of some examples of payments to be reported in box 1 of the 1099-NEC (this list is not exhaustive and does not replace the advice of your ShindelRock tax professional):

· Professional service fees, such as fees to attorneys (including corporations), accountants, architects, contractors, engineers, etc.

· Fees paid by one professional to another, such as fee-splitting or referral fees.

· Payments by attorneys to witnesses or experts in legal adjudication.

· Payment for services, including payment for parts or materials used to perform the services if supplying the parts or materials was incidental to providing the service. For example, report the total insurance company payments to an auto repair shop under a repair contract showing an amount for labor and another amount for parts, if furnishing parts was incidental to repairing the auto.

· Commissions paid to nonemployee salespersons that are subject to repayment but not repaid during the calendar year.

· A fee paid to a nonemployee, including an independent contractor, or travel reimbursement for which the nonemployee did not account to the payer, if the fee and reimbursement total at least $600. To help you determine whether someone is an independent contractor or an employee, see Pub. 15-A.

· Payments to nonemployee entertainers for services. Use Form 1042-S, Foreign Person’s U.S. Source Income Subject to Withholding, for payments to nonresident aliens.

· Exchanges of services between individuals in the course of their trades or businesses. For example, an attorney represents a painter for nonpayment of business debts in exchange for the painting of the attorney’s law offices. The amount reportable by each on Form 1099-NEC is the FMV of his or her own services performed. However, if the attorney represents the painter in a divorce proceeding, this is an activity that is unrelated to the painter’s trade or business. The attorney must report on Form 1099-NEC the value of his or her services. But the painter need not report on Form 1099-NEC the value of painting the law offices because the work is in exchange for legal services that are separate from the painter’s business.

· Taxable fringe benefits for nonemployees. For information on the valuation of fringe benefits, see Pub. 15-B.

· Gross oil and gas payments for a working interest.

· Payments to an insurance salesperson who is not your common law or statutory employee. See Pub. 15-A for the definition of employee. However, for termination payments to former insurance salespeople, see the instructions for box 3 of Form 1099-MISC.

· Directors’ fees as explained under Directors’ fees, earlier.

· Commissions paid to licensed lottery ticket sales agents as explained under Commissions paid to lottery ticket sales agents, earlier.

· Payments to section 530 (of the Revenue Act of 1978) workers. See the TIP under Independent contractor or employee, earlier.